Trust the newest wide range of Lenders given by HDFC Financial to find or construct your dream home. It is possible to choose transfer your current Home loan out of a different financial over to us to benefit from our very own loan offers.

At HDFC Bank, you may enjoy attractive Mortgage rates including an excellent hassle-free loan application process, effortless financing repayment possibilities, and flexible tenures. We provide a range of Home loans, together with Greatest Right up Loans, Do-it-yourself Financing, and you can Family Expansion Money.

Take advantage of the capability of trying to get financing on the web with the help of our intuitive electronic application process. While you prefer a bit of information along the way, we provide expert advice and you can fast customer support for everybody their Property Financing concerns.

- Attractive Rates of interest

- Smooth Digital Software Techniques

- More Topup off Upto ?50 lacs*

- Special Handling Costs to own Bodies Personnel

- Simple & Effortless Electronic Software Techniques

- No hidden costs

- Tailored repayment options to suit your needs

- Limit Better Up Mortgage out of ?50 lacs*

- Financing for present customers

- Attractive Interest rates???????

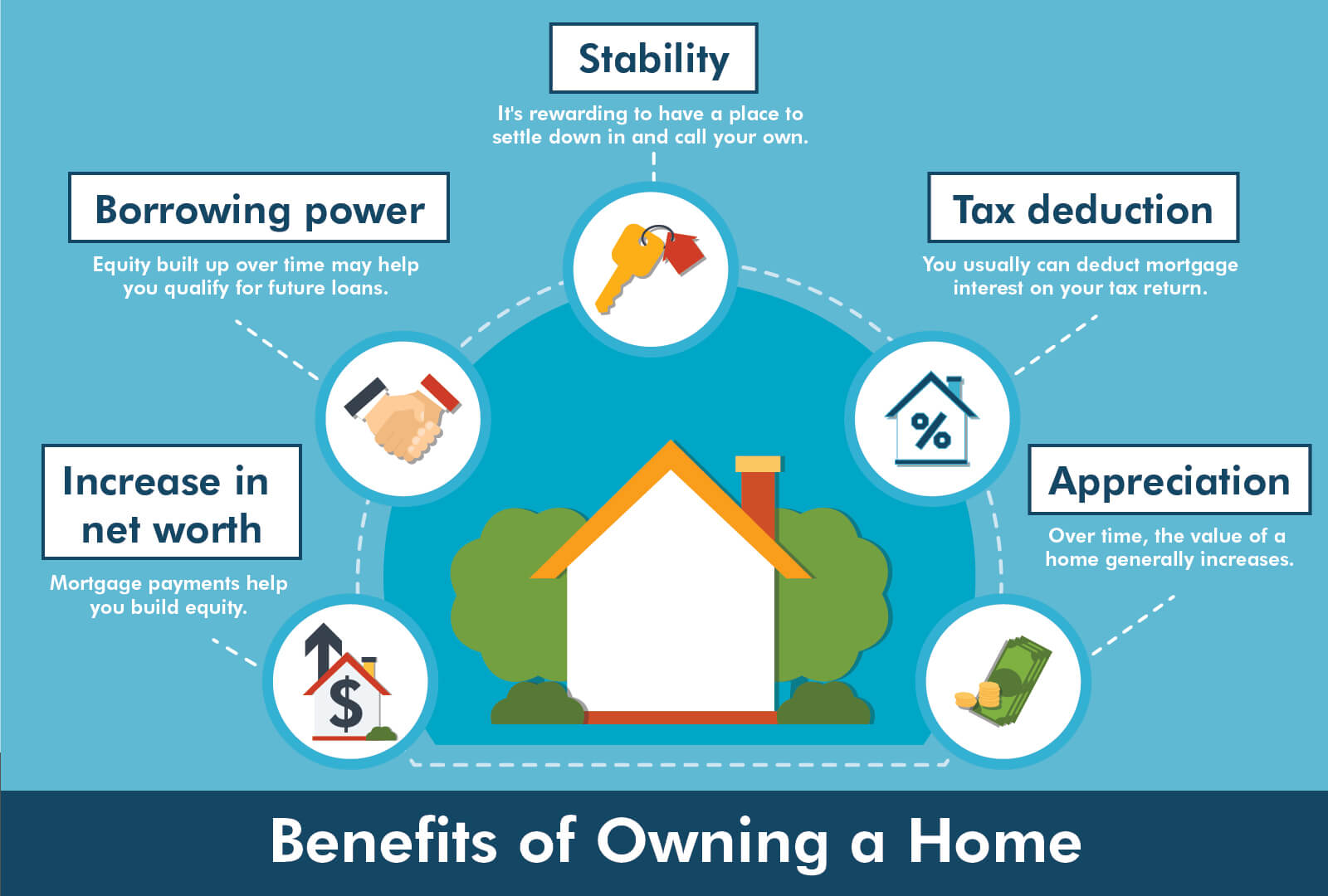

A mortgage is a kind of mortgage that one may get for purchasing a ready-produced assets, building your own house, or renovating/stretching your existing property. You could would an equilibrium Transfer of current household mortgage out over a special lender such as for example HDFC Bank having best Financial rates.

At HDFC Lender, you can get a home loan on line. The webpages try user-amicable and can naturally direct you from techniques. It’s also possible to check us out at your nearest HDFC Lender branch.

Once you submit an application for home financing, you can purchase 75 in order to 90% of your overall property pricing. Likewise, when your Mortgage is actually for build, do-it-yourself otherwise extension, next 75 in order to ninety% of your own structure/improvement/extension imagine will likely be funded. The remainder ten-25%, according to amount borrowed, can be your own sum.

Sure, with regards to the Income tax Act, 1961, you could avail of certain income tax advantages by paying a mortgage. Section 80C enables you to take advantage of good deduction from Rs 1.5 lakh to your dominant amount fees. As per Part 24, you might allege write-offs as much as Rs 2 lakh to your desire money. Part 80EE provides even more income tax advantages having very first time home buyers. A few of these income tax-protecting terms can be applied predicated on certain conditions and terms once the applied down by the Act.

Your own qualifications having home financing mainly relies on installment loans Columbus New Mexico activities like as your money and you may payment potential. Other than that, most other definitive activities tend to be how old you are, qualification, spousal income, level of dependents, possessions and you can obligations, offers records, and you will balances away from community, yet others.???????

Words & Criteria

The very first Fine print (MITC) of loan involving the Borrower/s – and you may Casing Innovation Fund Agency Limited, a buddies incorporated within the Businesses Operate, 1956 and having their inserted workplace at the Ramon Domestic, H T Parekh ation, Churchgate, Mumbai 400 020, hereinafter titled „HDFC“ is actually decided and you will stated because below:

Use Financial On the internet

(i) Type :(ii) Interest chargeable :(iii) Moratorium otherwise subsidy :(iv) Time out of reset of great interest :(v) Settings from interaction from alterations in Rate of interest : HDFC informs of these improvement in Merchandising Finest Credit Price (RPLR) courtesy a good ‚press release‘ within the big top news documents across the India as well as on the website hdfc.

(a) The amount of EMI :(b) Final amount out-of installments where loan are repayable inside equated monthly payments :

*At the mercy of type in terms of the mortgage arrangement conducted/ are performed within Debtor/s and you may HDFC. HDFC will endeavor to remain its Individuals informed of every transform when you look at the rates of interest with the officialwebsite (hdfc), yearly report of account, display in practices and you will general announcements fromtime in order to go out. If the for example changes is to try to this new downside of one’s buyers, he/she can get inside 60 days and you will without warning romantic their / their own membership or switch it without paying any extra costs or focus.