My FICO get is actually 630. You will find credit debt off 70K. Exploit was previously 690 partners months before(50k obligations).

I thought of shopping for an household(340k). What might all of you recommend? Am i going to get a mortgage using this rating?

Could it possibly be a first dependence on one to buy a home now? Or even require it quickly, then i will recommend you to definitely opt for a home loan immediately following there’s particular improvement in their get.

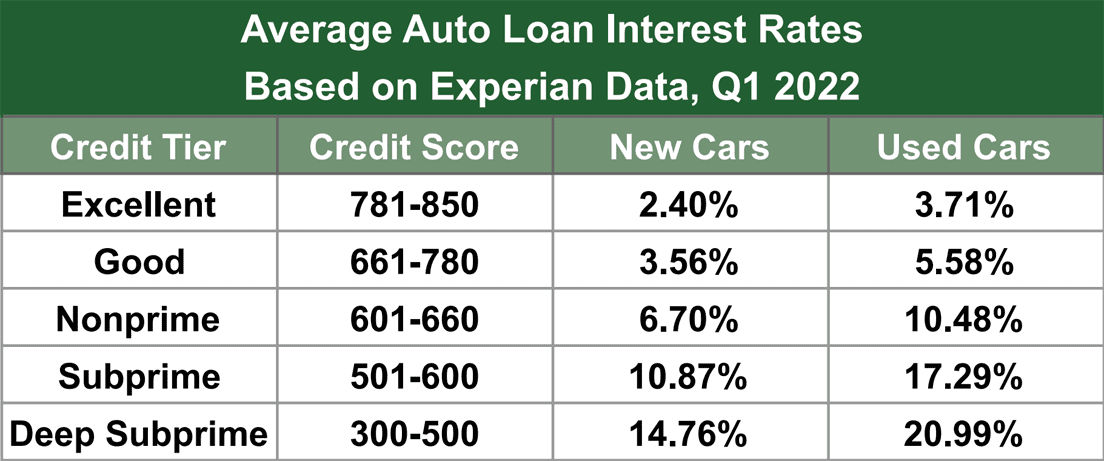

Having a get out of 630 you will be eligible for a great financial nevertheless rates will not be as little as your would love.

At least you could consider going for your house mortgage then. Regarding the mean time your own score commonly improve as you build new repayments.

Nevertheless hinges on their requirement. In the event the home specifications isnt an urgent situation it is better to hold off and then have a lower rate.

You may not be able to qualify for the best rates that have a get from 630 but you can rating standard rates otherwise a prime speed.

You can examine with various loan providers the pace plus the system that you may possibly qualify and watch whenever you can manage having your income and you will coupons. This new benchmark of credit history differs with assorted loan providers and you may relies on the amount of exposure they are prepared to accept.

When your commission matter is not appealing to you, then you definitely should wait for a bit and attempt to alter your score to locate a diminished speed.

680 might be a get to obtain the most acceptable cost although there are competitive home loan apps that enables your so you can qualify for home financing which have a rating 630.

It mostly depends on the sort of home loan system you favor along with different factors like payday loans Wilton Center, CT deposit that you are able, your income and your offers development.

Therefore, depending on your role you have got to simply take a choice.:) Paying off bills is a good idea as a result it never will get an encumbrance.

You may check out the considering web page to learn exactly how much house you are able to afford:

Don’t panic. The intention of this group is not to help you frighten your but we try here in order to kinds all of our difficulties by the common talk and you may hence help get an appropriate decision. 🙂

I experienced for taking money for personal resource(95% of credit line made use of)

Paying off expense in time is often a great and you’ll render limitation consideration so you’re able to it. Remainder of the requirements will immediately like you then.

There are numerous misconceptions here. Into a conforming financing having ratings more than 620 plus not as much as 620 an agent bank could you a conforming approval. DU (desktop computer underwriter) assesses exposure although your current credit rating do have been in play, youre likely to rating a higher level because of personal debt proportion and or deficiencies in supplies combined with ltv. That said it truly does not hurt to stay with a loan provider/agent and you may opinion your options. Your debt has to be a concern because min. fee has grown a whole lot to the alterations in brand new financial legislation the first of the year. And so the genuine concern you have got to wonder was: Manage I want to take on more financial obligation we.age a mortgage in the event that credit debt is indeed large. If you find yourself paying off 90% would-be high as long you proportion it’s also possible to use a few of those funds in the form of a straight down fee. simply my personal $.02