Whenever we continue using the amortisation formula, we are able to create a keen amortisation plan. Next dining table suggests the new amortisation agenda to the earliest a dozen months according to the analogy. You will notice just how it’s easy to do an enthusiastic amortisation schedule that have a predetermined-speed financial.

In accordance with the first year regarding amortisation plan, the full monthly installments do amount to ?a dozen,, with ?6, browsing interest fees. Just after 1 year, the capital equilibrium try smaller to ?218,.

When you remark the brand new desk, find just how attract repayments is greater than resource payments. Resource repaid towards very first fee was ?, while you are Interest paid back is actually ?. However with each spend several months, the main city percentage grows incrementally, as the focus payment are reduced too. By 12th percentage, the capital paid back increased to ?, since the attract repaid decreased in order to ?. Over the years, the main city money could be larger than the eye payments, until the financial harmony is very repaid.

While amortisation whittles out the mortgage equilibrium, it does thus in a very slow rate. Ergo, most other homeowners prefer to generate certified overpayments to attenuate the equilibrium quicker. Which shortens the term and you can lessens desire charge. And work out licensed overpayments can help you save a lot of money worthy of of great interest on your financial.

Essentially, loan providers will let you create an overpayment of ten% on your financial balance a year in the introductory period. Past you to, you must shell out very early fees charge.

A last Term

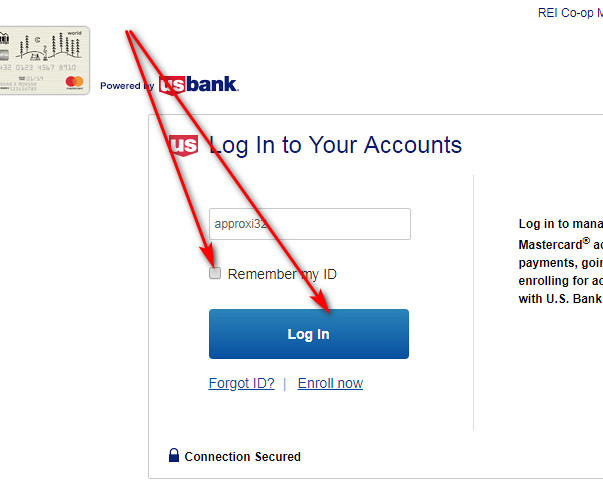

Tracking your monthly home loan repayments is vital, specifically if you propose to remortgage your loan most of the couple of age. You can do this by the record their mortgage’s amortisation schedule, or doing all of your individual data using the amortisation algorithm. Use the above calculator so you’re able to easily estimate the monthly payments.

Essentially, loan providers prefer borrowers just who pay on time, maintain reduced bank card stability, as well as have a constant income source

Amortisation involves making typical costs within this one particular time and energy to eradicate debt. Its a bookkeeping strategy placed on loans which have a specific capital number, rate of interest, and loan title. While it’s an easy task to implement to your fixed-rates mortgages, you need to recalculate monthly obligations in your amortisation whenever the interest rate alter. Regardless if loan providers and keep a https://paydayloanalabama.com/newville/ record of the amortisation plan, you possibly can make their observe their monthly premiums.

There are around three trick parameters that influence their mortgage payments. For example the administrative centre, which is the count you borrowed from; the speed, that’s according to an annual percentage rate (APR); and mortgage term, which is the decided repayment course. Providing a mortgage with a big investment results in costly monthly costs. If you can, generate increased put to attenuate your own capital and your desire rate.

As for the interest, individuals will probably found a reduced price and a favourable deal whether they have a premier credit score. Securing a decreased rate allows you to save on focus costs. This also provides you with place making overpayments, that enables very early mortgage payment. But generally, watch out for prepayment charges that could counterbalance your coupons.

As for the loan term, extremely British mortgage loans have a fees lifetime of 25 years. Consumers have the choice for taking repaired-price mortgages, and this continue for the initial 2 so you’re able to a decade of your own home loan. This is a well-known alternative one of homebuyers whilst features rather all the way down rates as compared to default SVR. Additionally brings secure, foreseeable payments which can be much simpler in order to finances. Until the introductory period finishes, borrowers can remortgage to another fixed rate loan to stop the fresh higher level for the SVR.